In today’s complex payroll environment, it’s easy to feel overwhelmed by confusing terms and abbreviations on your payslip. One such term that often raises eyebrows is “NIable Pay”. You may find yourself asking: what is NIable pay, and why does it matter? Understanding this essential payroll concept could make a real difference to how you interpret your earnings and contributions.

NIable pay stands at the core of how National Insurance contributions are calculated in the United Kingdom. It’s the portion of your earnings that HMRC considers when determining how much National Insurance you—and your employer—need to pay. If you’ve ever looked at your payslip and been unsure what this figure really means, this article will give you a clear, no-nonsense breakdown.

What is NIable Pay?

NIable pay—short for “National Insurance-able pay”—refers to the part of your gross income that is subject to National Insurance deductions. This includes wages, overtime, bonuses, statutory payments like sick pay or maternity pay, and some types of benefits. It’s the figure HMRC uses to calculate how much National Insurance you owe during a given pay period.

When you ask what is NIable pay, it’s important to note that it’s not always the same as your gross or taxable pay. Certain items may be excluded from NIable earnings, such as pension contributions made through salary sacrifice or specific employee benefits. As a result, NIable pay can sometimes be lower than your total gross income or even your taxable income.

How NIable Pay is Calculated

The calculation of NIable pay starts with your gross salary or wages. From this, employers subtract any items that are not subject to National Insurance, such as qualifying pension contributions, childcare vouchers through approved schemes, or salary sacrifice arrangements. The remaining figure is your NIable pay, which is then used to calculate both employee and employer NI contributions.

This is particularly important for people on flexible or variable pay structures, such as shift workers or those who regularly earn bonuses. Knowing what is NIable pay helps you anticipate what will actually be deducted and avoid surprises when payday arrives. Employers are legally obligated to calculate this correctly to ensure compliance with HMRC rules.

NIable Pay on Your Payslip

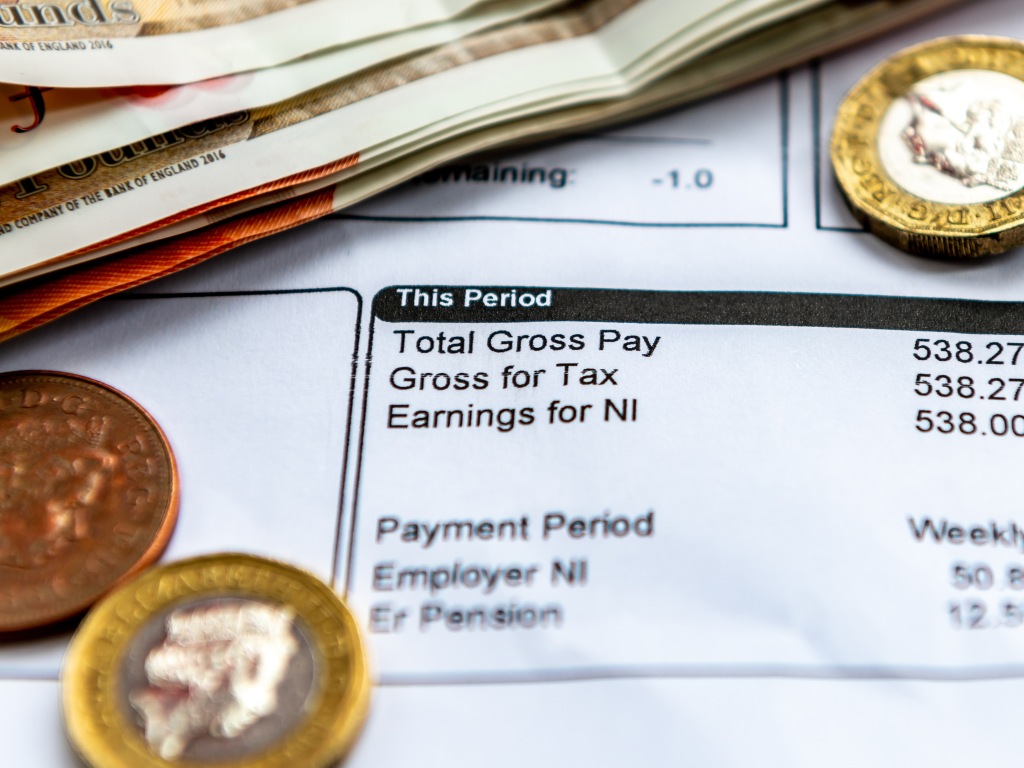

You can usually find your NIable pay clearly listed on your payslip, either labelled as “NI Earnings”, “NIable Pay”, or something similar. It’s the figure your National Insurance contributions have been based on for that specific period. Often, it sits next to your taxable pay, giving you a helpful side-by-side comparison of how your earnings are treated.

Many payslips also display NIable Pay YTD, meaning “Year to Date”. This shows the cumulative total of your earnings that have been subject to National Insurance contributions since the start of the current tax year. If you’re wondering what is NIable pay on a payslip, it’s essential for keeping track of your contributions over time and spotting any discrepancies early.

NIable Pay vs Taxable Pay

Although they sound similar, NIable pay and taxable pay are not identical. Taxable pay includes income that is subject to income tax, such as salary, bonuses, and benefits. NIable pay, on the other hand, is focused on earnings that trigger National Insurance deductions. While the two often overlap, they can vary due to the treatment of things like salary sacrifice or company car schemes.

If you’re asking, what is NIable pay and how is it different from taxable pay, here’s a simple example. Say you earn £2,000 per month. If you contribute £100 to a workplace pension via salary sacrifice, your NIable pay might drop to £1,900, while your taxable pay may stay the same. Understanding this distinction is vital for accurate financial planning.

Why NIable Pay Matters for Employees and Employers

For employees, knowing what NIable pay is means you’re empowered to understand how much National Insurance you’re contributing, what you’re entitled to in terms of state benefits, and whether your employer is making accurate deductions. It helps clarify how benefits like Statutory Maternity Pay or the State Pension are built up over time.

For employers, accurate NIable pay calculations are a legal responsibility. Incorrect reporting to HMRC can result in penalties, back payments, or even legal scrutiny. Understanding what counts as NIable ensures fair treatment for employees and avoids compliance issues that could affect business operations. In short, NIable pay is much more than a line on a payslip—it’s a financial foundation.

Common Confusions and Clarifications

People often ask, is NIable pay the same as gross pay? The answer is no. While gross pay includes all income before deductions, NIable pay is only the amount that qualifies for National Insurance. Another frequent query is what does NIable pay mean on payslip, which we’ve now covered in detail.

Other common searches include what is NIable pay YTD, NIable pay vs taxable pay, and difference between NIable pay and gross pay. All of these highlight a widespread need for clearer understanding of UK payroll language. Employers can do their part by offering payslip guidance, while employees should never hesitate to ask for clarification.

Conclusion

NIable pay may seem like a dry financial term, but it has a powerful impact on how your salary is processed and what contributions you make to National Insurance. Understanding what is NIable pay helps you decode your payslip, track your yearly deductions, and ensure everything is being calculated fairly and correctly.

Whether you’re new to payroll or just want to feel more in control of your finances, getting familiar with NIable pay is a smart step. By recognising how it differs from gross and taxable pay, and knowing where to find it on your payslip, you’ll be better equipped to manage your earnings and future entitlements.

Frequently Asked Questions (FAQs)

What does NIable pay mean?

NIable pay is the portion of your earnings used to calculate National Insurance contributions in the UK.

Is NIable pay the same as gross pay?

No, gross pay is your total earnings before any deductions, while NIable pay is the part subject to National Insurance.

What is NIable pay YTD?

This stands for Year to Date NIable Pay, showing the total amount of earnings that have been liable for NI in the current tax year.

Where do I find NIable pay on my payslip?

It’s typically listed as “NI Earnings” or “NIable Pay”, often near your gross and taxable pay.

What’s the difference between taxable pay and NIable pay?

Taxable pay is subject to income tax, while NIable pay is subject to National Insurance. The amounts can vary based on deductions or schemes.

You may also read: Green Smoke Living Room Ideas for a Cozy and Elegant Makeover