Bumper Finance: 0% Interest Car Repair Payments Across the UK

Car trouble rarely comes with a warning, and it almost never happens at a convenient time. Whether it’s an MOT failure, engine issue, or urgent tyre replacement, unexpected repairs can cause financial stress. That’s where bumper finance offers a welcome solution for UK drivers. With 0% interest and flexible repayment terms, bumper finance is designed to make motoring costs more manageable without hidden fees or complicated contracts.

Bumper finance works seamlessly with garages and dealerships across the UK, allowing motorists to spread the cost of vehicle servicing and repairs over several months. Instead of paying a large lump sum upfront, drivers can break the total into interest-free monthly instalments. This not only makes car maintenance more affordable but also ensures vehicles stay safe and roadworthy without compromising household budgets.

What Is Bumper Finance and How Does It Work?

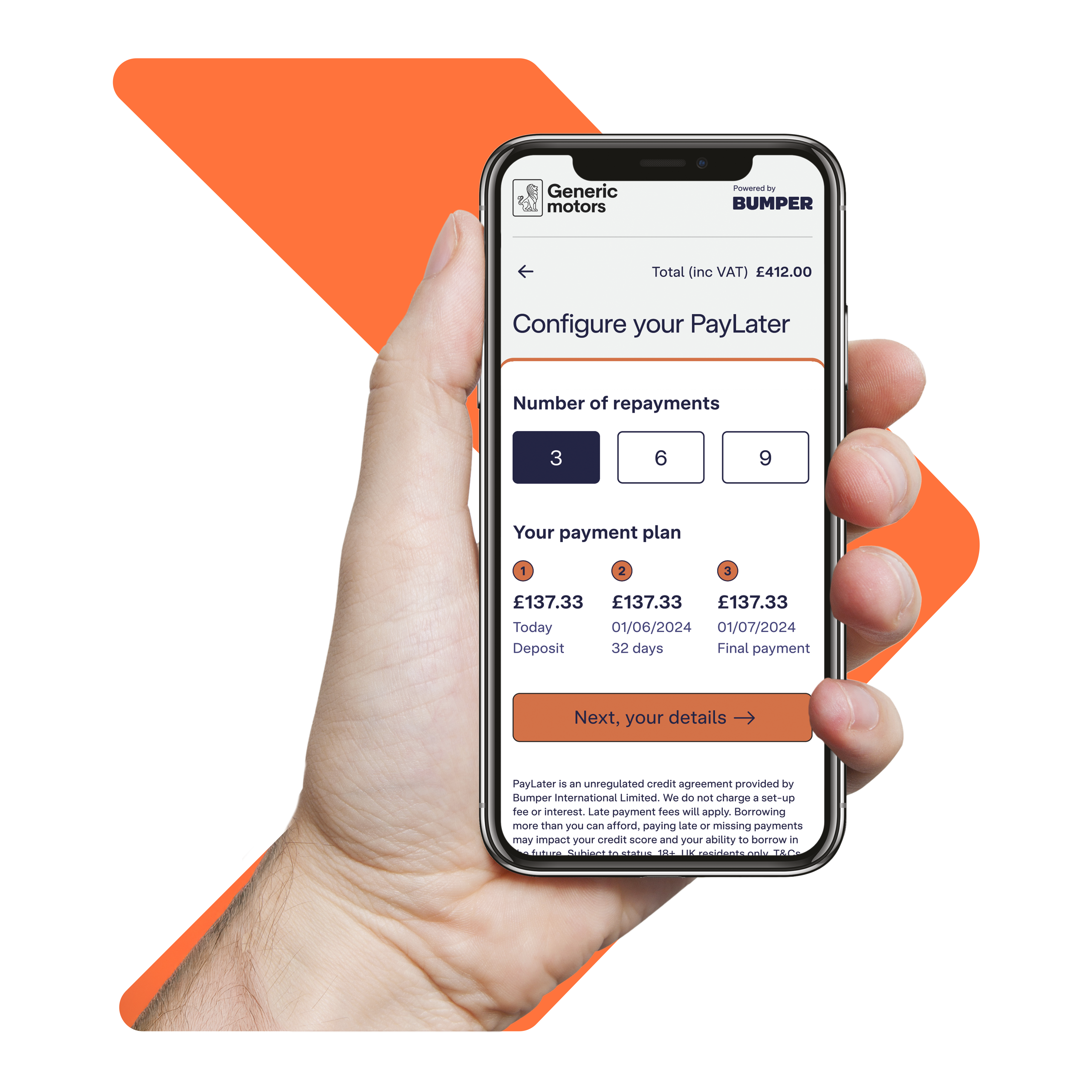

Bumper finance is a UK-based digital payment platform that partners with garages to provide customers with a “fix now, pay later” option. It gives drivers the ability to divide repair bills into smaller, manageable payments over a three or six-month period — all without paying any interest. The service is available at hundreds of garages nationwide, including major names like Kwik Fit, making it both accessible and convenient.

When you take your car in for repairs at a participating garage, the service advisor may offer bumper finance as a payment method. The approval process is simple and takes just a few minutes. Unlike traditional financing, there are no lengthy forms, hidden charges, or intrusive credit checks. The entire process is digital, and once approved, you can drive away knowing your repair costs are covered — and your payments are planned.

Key Features and Benefits of Bumper Finance

The standout feature of bumper finance is the 0% interest on all payment plans. This means you only pay for the work done on your vehicle — nothing more. With inflation and rising living costs squeezing UK households, avoiding interest charges is a valuable advantage. Bumper finance provides financial breathing room for unexpected bills without the burden of debt or late fees.

Flexibility is another major plus. Customers can choose from several repayment options, usually across three or six months, depending on the total cost of the repair. There are no penalties for early repayment, and monthly reminders help you stay on track. For many drivers, the peace of mind that comes with splitting payments instead of draining savings is worth its weight in gold.

Using the Bumper Finance Portal and Login Features

Once you’ve enrolled, managing your account is easy through the bumper finance login portal. This online dashboard allows customers to view upcoming payments, update personal details, and contact support if needed. The portal is mobile-friendly, secure, and designed with user convenience in mind — you’re never more than a click away from control.

If you ever encounter trouble logging in, features like the bumper finance token system are in place to keep your account secure. Many users appreciate the transparency of the portal. Unlike some credit services, bumper finance shows exactly what you owe, when payments are due, and offers helpful prompts to ensure nothing gets missed.

How to Contact Bumper Finance Customer Support

Getting help when you need it is easy thanks to the responsive support team behind bumper finance. If you have questions about your account, need help logging in, or want to know more about a transaction, you can reach them via the bumper finance contact number provided on the official website. Support is available during regular bumper finance opening times, and response times are generally quick.

For less urgent queries, there’s also an online contact form and a helpful FAQ section. Whether you’re a customer or a garage looking to offer bumper finance to your clients, support is never far away. Having a reliable contact option adds trust to the overall experience, helping you stay confident in the service from start to finish.

Real Customer Reviews and Experiences

Trust is everything in finance — especially when it comes to your car. Thankfully, bumper finance reviews speak for themselves. Across platforms like Trustpilot, Google, and Facebook, thousands of UK drivers have shared their positive experiences using the service. Common themes include ease of use, fair terms, and excellent customer service.

Many reviewers mention how bumper finance helped them avoid financial hardship during an unexpected car issue. Others highlight how simple the process is, with minimal paperwork and no pressure to sign up. For families, students, and anyone on a tight budget, bumper finance has proven to be a lifeline — not just a payment method.

The Kwik Fit and Bumper Finance Partnership

One of the strongest partnerships in the UK car service market is between Kwik Fit and bumper finance. This collaboration allows customers to pay for services like tyres, brakes, and MOTs in instalments directly through Kwik Fit branches. It brings convenience and financial support together in one smooth customer journey.

When booking your service with Kwik Fit, you can request bumper finance either online or in-store. The process is fully integrated, and staff are trained to guide you through it. You leave with the work done and the reassurance that your payments are sorted. It’s a clear win for anyone who relies on their vehicle but wants to avoid large one-off costs.

Bumper Finance in the UK Automotive Market

The rise of bumper finance UK is a sign of changing attitudes towards car repair costs. More UK drivers are moving away from high-interest credit cards and toward flexible, transparent finance options. Bumper finance meets this demand perfectly, offering a tech-first, user-friendly approach that fits into today’s digital lifestyle.

From a market perspective, bumper finance is reshaping the way garages do business too. By offering an interest-free option, they make their services more accessible, helping customers say “yes” to necessary work they may have otherwise delayed. It’s a win-win — customers stay safe, and garages stay busy.

Final Thoughts on Choosing Bumper Finance

Bumper finance isn’t just a payment option — it’s a smarter way to manage unexpected motoring expenses. With 0% interest, a fast application process, and trusted UK garage partnerships, it’s built with everyday drivers in mind. Whether you need a quick fix or a major repair, bumper finance gives you the flexibility and peace of mind to move forward without financial stress.

If you’re planning your next car service or facing a sudden repair bill, ask your garage about bumper finance. It’s transparent, secure, and designed to help UK drivers take control of their vehicle expenses — without the usual financial pitfalls.

FAQs

What is bumper finance?

Bumper finance is a UK-based service that allows customers to spread the cost of car repairs and servicing over interest-free monthly payments.

How do I log in to my bumper finance account?

You can log in through the bumper finance portal using your email and secure token. From there, you can manage payments and view your schedule.

What is the bumper finance contact number?

Visit the official Bumper website to find the current contact number and opening times for their customer support team.

Is bumper finance available at Kwik Fit?

Yes, Kwik Fit partners with bumper finance, allowing you to use it for tyres, MOTs, and repairs across the UK.

Does bumper finance charge interest?

No. All bumper finance plans are interest-free, meaning you only pay the original cost of your car repairs or service.

You may also read: Lowestoft Journal – Latest News, Sport & Things to Do in Suffolk