BT Share Price Today: Live Updates, History, Dividends & Forecast

BT share price remains a key focus for investors in the UK financial market. As one of the largest telecommunications companies in the country, BT Group provides fixed-line, broadband, mobile services, and digital solutions to millions of customers. Understanding BT share price movements allows investors to gauge the company’s performance, track market trends, and make informed investment decisions.

Investors monitoring BT share price today benefit from real-time insights into market fluctuations, trading volumes, and price trends. By keeping a close watch, stakeholders can identify potential buying or selling opportunities, while also assessing BT’s position relative to other major UK and international stocks. Real-time data ensures that investment strategies remain timely and well-informed.

BT Share Price Overview

The BT share price is influenced by a combination of company-specific factors, industry dynamics, and broader economic conditions. Currently, BT share price reflects investor sentiment, trading activity, and corporate announcements such as earnings, dividends, and strategic initiatives. Market analysts often highlight BT’s valuation metrics, including market capitalisation and P/E ratios, when evaluating the stock’s attractiveness.

Comparing BT share price with other prominent stocks, including Lloyds share price, Rolls Royce share price, Tesla share price, BP share price, and IAG share price, provides investors with perspective on its relative performance. Such comparisons can highlight BT’s strengths, growth potential, and risks, enabling more strategic portfolio decisions in the competitive investment landscape.

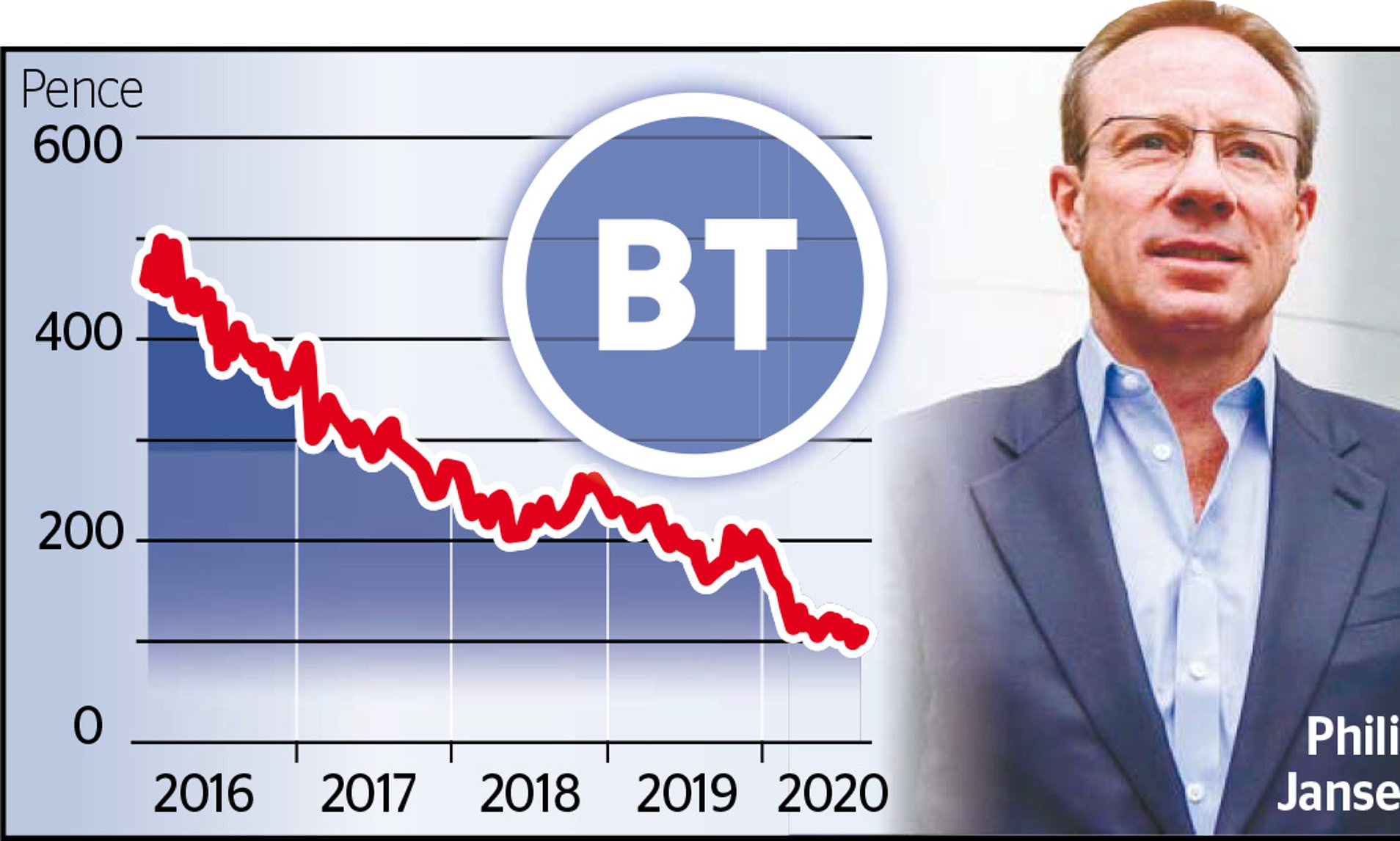

Historical Performance of BT Shares

BT share price has exhibited significant fluctuations over the years, shaped by business developments, industry trends, and economic events. Historical performance provides investors with a framework to understand the company’s market resilience and potential future performance. Patterns in BT share price often reflect reactions to new service launches, regulatory changes, and shifts in consumer demand.

When placed alongside companies such as Nvidia share price, GGP share price, BAE share price, and EUA share price, BT share price demonstrates how telecom stocks compare with technology, defence, and energy sectors. Studying these comparisons helps investors identify broader market trends and potential opportunities, ensuring that BT share price is contextualised within a diversified investment strategy.

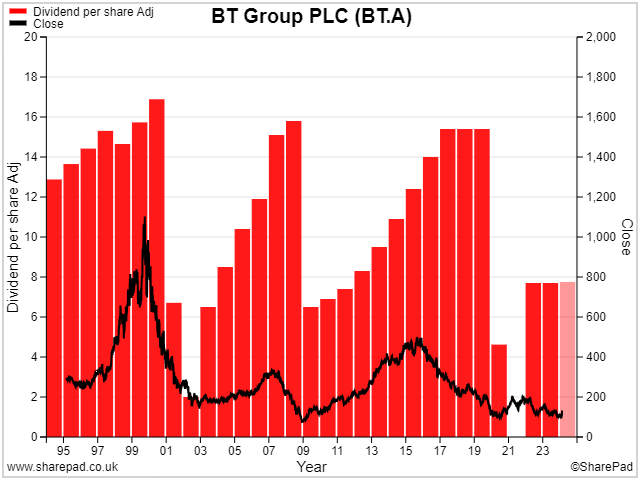

Dividends and Returns

BT share price is closely associated with its dividend policies, which provide investors with regular income streams. The company maintains a consistent dividend record, distributing payouts quarterly, and offering attractive yields relative to other UK stocks. Dividend stability adds confidence for long-term investors, making BT shares a balanced option for growth and income.

When evaluating BT share price, it is essential to compare dividends with other key stocks such as Tesco share price, HSBC share price, Aviva share price, and Barclays share price. These comparisons help investors determine which companies provide the best income potential, while also considering total shareholder returns. Dividends, combined with capital appreciation, significantly contribute to overall portfolio performance.

BT Share Price Forecast and Market Outlook

Analysts expect BT share price to show moderate growth in the coming months, supported by expanding broadband networks, mobile services, and enterprise solutions. Short-term fluctuations may occur due to economic indicators, sector competition, and investor sentiment, but the long-term outlook remains favourable for those tracking BT share price carefully.

By comparing BT share price with EasyJet share price, Legal and General share price, Shell share price, GSK share price, and Vodafone share price, investors gain insights into broader market movements. These comparisons provide a clearer picture of BT’s potential relative to other sectors and highlight opportunities for diversification in a well-balanced investment portfolio.

How to Invest in BT Shares

Investing in BT share price requires understanding the UK stock market, trading platforms, and risk management techniques. Investors can buy shares through the London Stock Exchange, online brokers, or investment funds. Regularly monitoring BT share price ensures that entry and exit decisions are aligned with market conditions, helping optimise returns.

Risk assessment is crucial when dealing with BT share price, as fluctuations are inevitable. Combining investments in BT with other stocks like Lloyds share price, BP share price, and Rolls Royce share price can help reduce exposure to market volatility. Diversification ensures that investors are not overly reliant on a single stock while still benefiting from BT share price potential.

BT Share Price and Market Comparison

Investors often compare BT share price with other UK and global companies to evaluate its performance. Stocks like Nvidia share price, Tesla share price, and Vodafone share price are popular comparison points. Such analysis helps investors identify trends, growth opportunities, and risks associated with holding BT shares alongside other equities.

Comparing BT share price with energy and finance stocks like BP share price, Shell share price, HSBC share price, and Barclays share price allows investors to assess sector-specific influences. These comparisons provide a strategic framework for decision-making, helping investors diversify their portfolios while leveraging insights from BT share price behaviour.

Conclusion

BT share price offers a comprehensive view of the company’s financial health, investor confidence, and market potential. Tracking live updates, historical trends, dividends, and forecasts equips investors with essential information to make informed decisions. Comparing BT share price with other stocks enhances understanding of its relative performance and long-term prospects.

Investors seeking a balanced portfolio can benefit from monitoring BT share price alongside other UK and global equities. By combining careful analysis, timely trading decisions, and diversification, BT share price can be an integral part of a successful investment strategy in the UK market.

You may also read: Head-to-Head and Previous Encounters