Tesco Car Insurance – Compare Quotes & Save with Clubcard Deals

Choosing the right car insurance policy can often feel overwhelming. With dozens of providers offering similar coverage at first glance, it’s the fine details—and hidden perks—that make one option stand out from the rest. Tesco Car Insurance, backed by the trusted name of Tesco Bank, brings not only peace of mind but real savings to everyday UK drivers. Whether you’re after a basic third-party policy or a comprehensive package with added extras, Tesco offers flexibility and convenience for drivers across the country.

More than just another insurance provider, Tesco Car Insurance stands out for its exclusive Clubcard pricing, multiple levels of cover, and straightforward online experience. It’s designed to help you get insured faster, cheaper, and smarter. If you’re tired of navigating endless quotes from providers like Admiral, Aviva, or Go Compare, Tesco could be the streamlined solution you’ve been waiting for.

What Makes Tesco Car Insurance Unique?

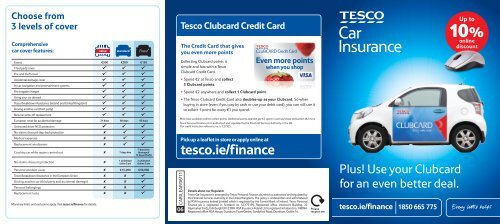

The Tesco Car Insurance offers three distinct levels of cover: Bronze, Silver and Gold. Each option comes with its own set of benefits, allowing drivers to choose the package that best fits their budget and driving style. Bronze provides essential cover for those seeking affordability, while Gold adds premium features such as enhanced personal accident cover and key replacement—ideal for those who want total peace of mind.

One of Tesco’s biggest advantages is the integration of Clubcard pricing. If you’re already a Tesco Clubcard holder, you unlock discounted premiums exclusive to you. This isn’t just a gimmick—it can lead to significant savings compared to other insurance providers. Additionally, Clubcard customers can benefit from regular promotional offers and loyalty-based pricing. It’s a clever way Tesco links your shopping habits to insurance value, rewarding customer loyalty beyond the supermarket aisle.

Features and Benefits of Tesco Car Insurance

A standout feature of Tesco Car Insurance is its digital-first experience. Policyholders can manage everything from claims to renewals online using Tesco Bank’s intuitive customer portal. This saves time and eliminates the traditional hassle of phone calls and paperwork. You can also retrieve previous quotes, adjust your details, or add optional extras without delay.

Tesco’s optional add-ons include legal cover, breakdown assistance, key protection and courtesy cars. These extras are competitively priced and can be included when you take out your policy. Tesco also offers a Black Box (Telematics) policy for younger or first-time drivers, which uses driving data to adjust premiums. This can be a great way for responsible drivers to save money—especially those aged 17 to 25.

How Tesco Car Insurance Compares to Other Providers

When placed alongside major providers like Admiral Car Insurance, Aviva, or Acorn Insurance, Tesco Car Insurance remains highly competitive. While Admiral is known for its multi-car discounts and Aviva for its large-scale customer base, Tesco appeals to drivers who value simplicity, savings, and online convenience. Its integration with Clubcard pricing creates a more personalised experience that most traditional insurers don’t offer.

Using comparison sites like Compare the Market Car Insurance, Go Compare Car Insurance, and MoneySuperMarket can help you stack Tesco’s offerings against the competition. In many cases, Tesco’s premiums come in lower, especially for those who qualify for Clubcard discounts. If you’re shopping for cheap car insurance that doesn’t cut corners on cover, Tesco is well worth including in your shortlist.

Tesco’s Additional Insurance Products

Tesco Bank isn’t just about cars—it’s a one-stop-shop for a wide range of insurance products. Tesco Travel Insurance offers protection for single trips, annual policies, and even European or worldwide cover. It includes optional extras like cruise cover, gadget protection and cancellation coverage—ideal for families or frequent travellers. Tesco’s holiday insurance can be tailored to meet the demands of both last-minute and well-planned getaways.

Additionally, Tesco offers home insurance with flexible buildings and contents cover, as well as Tesco Pet Insurance for cats and dogs. Their pet policies cover vet fees, accidents, and even dental treatment. Life insurance is also available through Tesco Bank, offering both level term and decreasing term cover for families. If you’re a Tesco customer across multiple services, there’s strong incentive to keep all your insurance needs under one roof.

What About Temporary and Van Insurance?

While Tesco Car Insurance does not currently offer temporary or short-term car insurance directly, it still remains a strong permanent insurance option for most drivers. If you’re looking for temporary car insurance—say, for borrowing a friend’s car or test-driving a new one—you may need to explore third-party providers that specialise in flexible cover. That said, Tesco policies can be cancelled or adjusted with relative ease if needed.

Tesco also provides van insurance for eligible drivers. Whether you’re self-employed or using your van for commuting, Tesco’s cover includes the same Clubcard discounts and optional extras. It’s a good solution for tradespeople and small business owners who want straightforward protection without excessive paperwork.

How to Get a Tesco Car Insurance Quote

Getting a quote from Tesco is refreshingly quick. You can start online in just a few minutes by entering your car details, personal information, and driving history. The system is built for clarity and speed—there are no hidden extras or surprise fees. If you have a Clubcard, simply enter your number to see discounted rates instantly applied.

If you’re not ready to commit straight away, Tesco allows you to save and retrieve your quote later. This is particularly useful when comparing with other providers like Admiral Insurance or Aviva Car Insurance. Always take the time to review your voluntary excess, mileage estimate, and policy extras before finalising your quote to make sure you’re getting the best possible deal.

Real Reviews and Customer Experiences

Many Tesco Car Insurance customers report positive experiences across the board. Users on sites like Trustpilot often praise the simplicity of the online platform, the value offered through Clubcard discounts, and the ease of making policy adjustments. Customers find it convenient that everything is accessible online and that Tesco’s claim process is relatively efficient.

Of course, no provider is perfect. Some users have reported delays during busy claim periods or confusion over policy wording. Like with any insurance product, it’s essential to read the terms carefully and contact customer service if anything is unclear. Overall, Tesco receives consistently strong feedback, making it a dependable choice for first-time and returning drivers alike.

Choosing the Right Policy with Tesco

When selecting your Tesco Car Insurance policy, consider your needs beyond the minimum legal requirement. Do you drive daily or occasionally? Do you park on a driveway or the street? Are you covering long distances? Your answers will shape whether Bronze, Silver or Gold is the best fit. Be sure to weigh up the cost of optional extras, which can offer better value than expected.

If you’re on a tight budget, consider increasing your voluntary excess or opting for a Black Box policy. This allows Tesco to lower your premiums in exchange for safer driving. For multi-vehicle households, comparing Tesco’s pricing with multi-car options from other providers may also reveal hidden savings.

Why Tesco Car Insurance is Worth Considering

Tesco Car Insurance strikes a strong balance between affordability and comprehensive cover. With a trusted UK brand behind it, this insurance option gives policyholders confidence as well as convenience. Add in Clubcard pricing, and it becomes an appealing choice for thousands of UK drivers.

Whether you’re insuring your first car, renewing an existing policy, or switching from another provider, Tesco makes the process simple. With transparent pricing, flexible features and the added perk of loyalty-based savings, it’s an insurer that truly works around your lifestyle.

Frequently Asked Questions

Does Tesco Car Insurance offer temporary cover?

No, temporary cover isn’t currently offered, but flexible cancellation options are available.

Is Tesco Car Insurance good for new drivers?

Yes, particularly with its Black Box option for younger or less experienced drivers.

How do I get a Clubcard discount on my policy?

Just enter your Clubcard number during the quote process and discounted rates will apply.

Can I manage my Tesco Car Insurance online?

Absolutely—Tesco Bank offers a full-service online portal for claims, updates, and renewals.

Is Tesco Car Insurance cheaper than Admiral or Aviva?

It can be, especially with Clubcard pricing. Always compare car insurance quotes before buying.

You may also read: Lenovo Warranty Check – The Complete UK Guide to Warranty Lookup, Claims, and Extensions